One of the terms that have been making a buzz in the crypto industry over the past couple of years is ‘Decentralized Finance’ – commonly referred to as DeFi. Another term that is the second closest is Decentralized Finance (DeFi) Development, as the demand for expert blockchain developers is rising.

Traditionally, we are accustomed to using physical means of finances that are governed by central intermediaries such as banks, government, or exchanges.

But, what if there was a way of performing financial transactions without intermediaries and such that complete control is always in the hands of the user?

That’s exactly what DeFi is.

In this article, you’ll get to know everything there is to know about Decentralized Finance, including what it is, how it works, what are the benefits and use cases, and how you can build your own app on DeFi.

Let’s start with the basics.

What is Decentralized Finance (DeFi)?

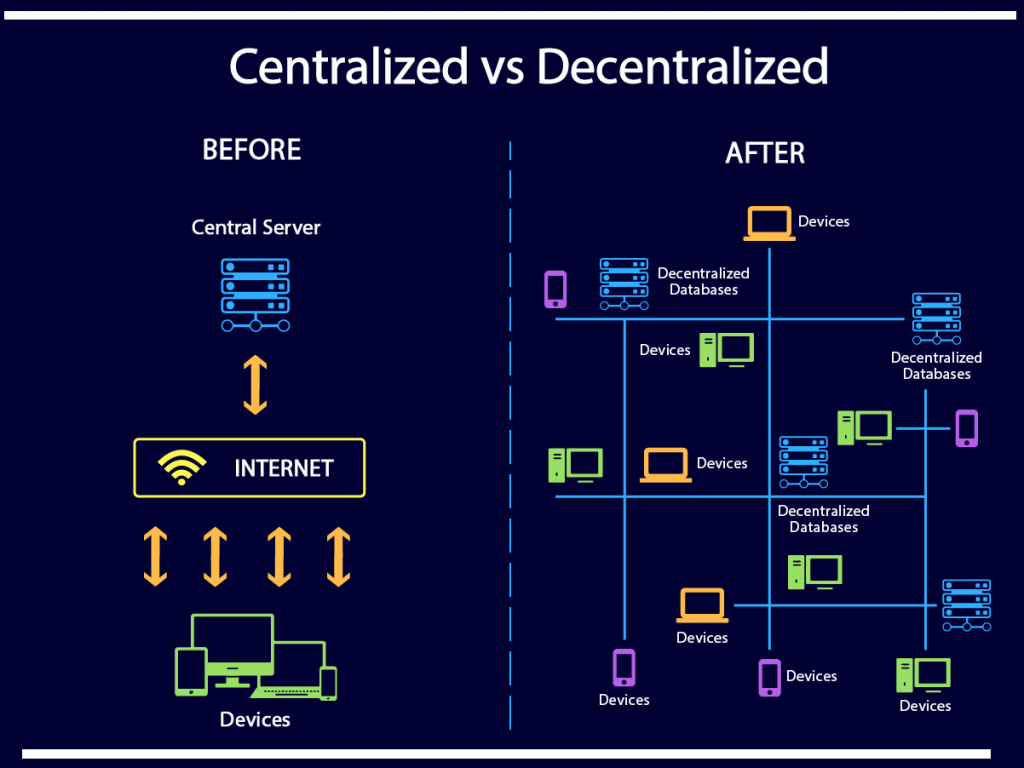

Decentralized Finance, or DeFi, is a financial system that enables people to make financial transactions, such as payments and money transfers, without relying on a central entity like banks.

Instead, a DeFi system uses smart contracts (usually based on the Ethereum blockchain) to automatically verify and process digital transactions.

In a DeFi ecosystem, financial applications are built on the blockchain, which is a distributed ledger technology (DLT).

Blockchain is a decentralized technology that enables peer-to-peer financial transactions between users in a network.

The blockchain network consists of thousands, if not millions, of servers (called nodes) located worldwide and storing data in a secure (encrypted) and immutable fashion such that everything on the network is public but highly secure.

Examples of DeFi apps range across a variety of financial instruments, from lending/borrowing platforms to decentralized apps (DApps) and stablecoins.

One of the main goals of DeFi is to enable easy & quick access to digitized financial services, especially for those who reside in remote areas and are deprived of basic financial services.

If you are wondering how DeFi can benefit you or your business or what features make DeFi better than the existing systems, here you go.

Unlike traditional finance which completely relies on intermediaries like banks to process transactions, DeFi offers a way to perform financial transactions without middlemen.

All the transactions, as well as disputes in a DeFi system, are governed by a computer code.

All the time, the users have complete control over their funds, which is another reason why DeFi is revolutionary.

Without the middlemen, the cost of using these financial services is reduced, and so are the processing time and complexity.

Since all the services and data are deployed in the Ethereum blockchain, everything is more secure, transparent, and fast.

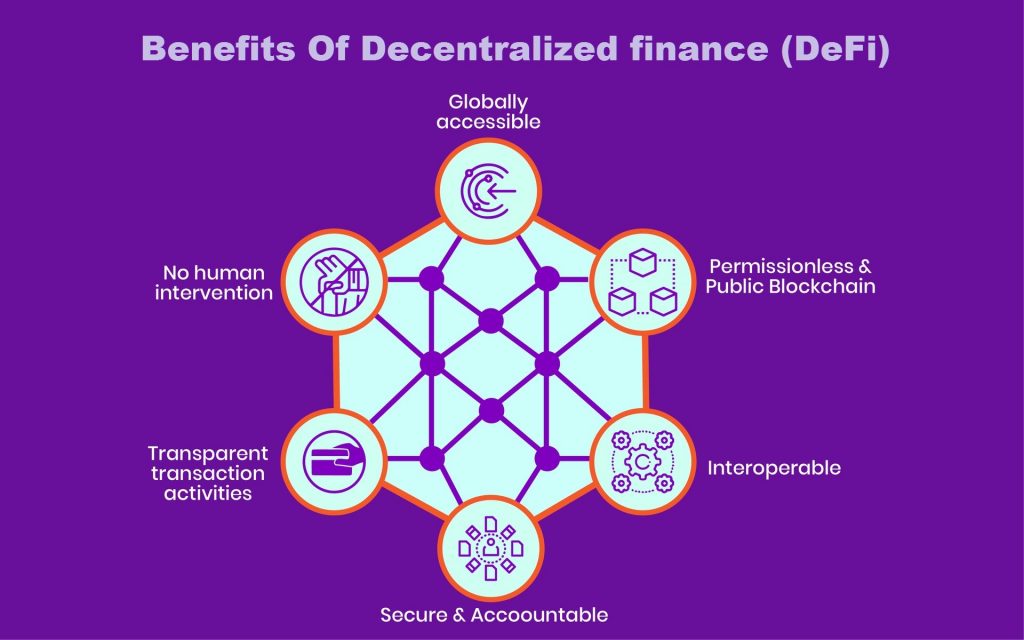

Other top benefits of the DeFi system include:

Smart Contracts

One of the best features of DeFi is smart contracts, which are programmable digital contracts designed to be auto-executed.

These smart contracts can be programmed to perform literally any kind of digital financial transaction involving money and requiring trust.

Immutability

One of the core features of blockchain is immutability, which ensures that the data and records stored in a blockchain ledger cannot be changed or modified without a proper procedure that involves getting permission from all the nodes in the network.

Basically, it’s impossible to tamper with a blockchain record without everyone in the network knowing about it.

Security

Since the blockchain is a decentralized system with all its records public and immutable, security is higher compared to centralized systems where all the rights are enjoyed by a central entity or person.

Transparency

In a DeFi ecosystem (blockchain), every transaction goes through and is verified by every node on the network, which means every single network activity is visible to everyone in the system.

This increases transparency and allows a user to access the network activity anytime they want. Also, the open-source nature of blockchain enables users to access, audit, and build upon the source code.

No Single Point of Error

In a blockchain-based DeFi system, all financial services and records are stored in a decentralized ledger that is distributed across thousands of nodes, eliminating single points of error.

Even if one or two nodes are down because of some error, the network keeps running as a whole.

Ease of Global Access

Another great advantage of DeFi – open finance ecosystem – is the ease of access to financial services, especially for individuals and small businesses with limited or no access to traditional financial services because of the high intermediary cost.

Since there are no intermediaries in DeFi and deployment is easier & less complicated, it’s easily accessible to everyone, including low-income individuals worldwide.

Permissionless

Unlike traditional finance, where users are required to have certain permission or minimum balance to perform a transaction, DeFi grants open, permissionless access to anyone and everyone, irrespective of their financial status or location.

Anyone with a crypto wallet can access and use DeFi for any suitable purpose.

DeFi and Smart Contracts

Smart Contracts are the backbone of DeFi. These are digital contracts that allow people to perform monetary transactions, make trades, buy/sell things and more in a totally peer-to-peer manner.

Since smart contracts are pure code, they are free of human errors and will always execute a transaction according to the underlying conditions, no matter what.

DeFi Smart Contracts can be used in a range of financial transactions. For instance, the traditional way of getting a mortgage can be costly and time-consuming, but with smart contracts, you can get a mortgage loan for almost zero (intermediary) fee.

Also, you don’t have to share any private information with any person while performing such transactions on DeFi.

Examples and Use Case of DeFi

Now that you know the basics of DeFi, including the various benefits & features, the next thing to discuss is the possible (& existing) use cases and examples of Decentralized Finance (DeFi) Development.

Theoretically, DeFi can be used anywhere or by any system that deals with financial transactions or the exchange of something of value.

For instance, traditional money exchange, loans, banking, payments, and related services can be performed via DeFi in a totally transparent and peer-to-peer manner.

Here are some more robust use cases and possible applications of Decentralized Finance (DeFi) Development.

Financial Banking Services

As the main purpose of decentralized finance was to make people free of centralized, bank-dominated finance systems, the most prominent use case of this technology is in finance and banking services.

A number of banking services, including money transfers, payments, loans, insurance, issuance of currencies, etc. can be performed using DeFi.

In fact, there are DeFi systems backed by smart contracts that actually allow people to make payments and transfer money using cryptocurrencies.

Stablecoins, for instance, are a perfect example of a digital currency on the blockchain that gets its value from a real-world asset.

While delivering the same value as the physical asset, it improves liquidity and enables users to transfer/trade assets easily.

Unlike regular cryptocurrencies that are highly volatile in nature and, therefore, not fit for everyday use, stablecoins can be used the same way as fiat currencies, but in a digital and decentralized manner.

The traditional insurance system works through agents or brokers who charge a commission for their service.

With the use of DeFi, the need and cost of intermediaries will be eliminated, thus making the process cheaper and the premiums lower.

Also, by automating the insurance process, including the claims, the probability of fraud will also be reduced.

Asset Storage & Management

On a blockchain network, a user is always the owner of his/her funds. In other words, you are not required to trust a third party or middleman like a bank with the management of your funds on a DeFi network.

Using a crypto wallet like MetaMask, you can securely manage your crypto assets as well as use them for transactions such as buying, selling, lending, borrowing, and transferring cryptocurrencies.

No other entity, but you, has access to your private keys, wallet passwords, and seed phrase and cannot access your account without your permission.

We’ve Helped Hundreds Of Businesses Build Their Applications On Blockchain.

We Can Help You Too!

To Know How

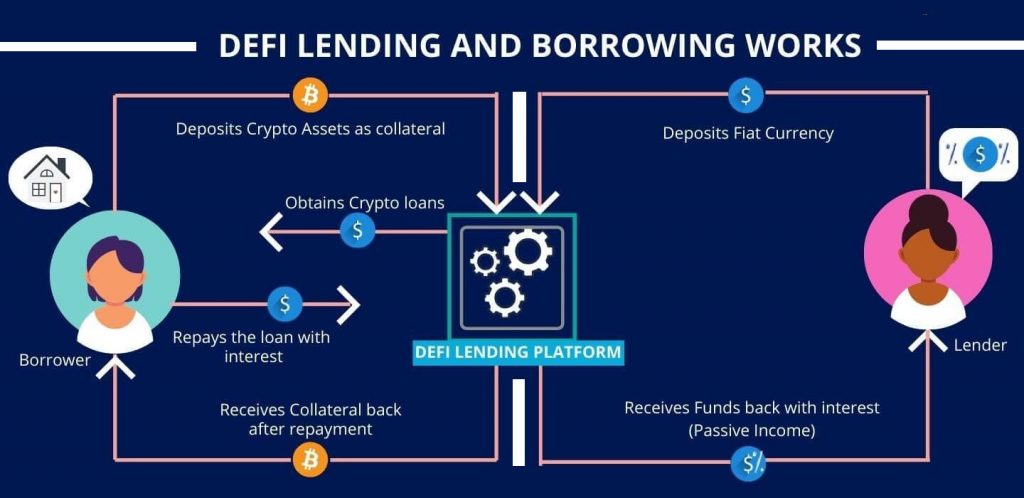

Borrowing And Lending

One of the industries that are expected to benefit the most from the DeFi ecosystem is the credit system, i.e. lending and borrowing.

DeFi has given a boost to the popularity of Open Lending Protocols, which involve lending and borrowing over a decentralized system.

Some of the advantages include quick fund processing, low transaction cost, digital assets as collateral, and no credit checks.

Also, the DeFi-based lending and borrowing process is secured through cryptographic methods and reduces the probability of fraud.

Compliance Through KYT

Against the traditional way of compliance that involves verifying the KYC (know-your-customer) details of a person manually, the blockchain offers a next-gen and more efficient way of compliance that analyses the participant’s address rather than their identity.

This mechanism of compliance, called know-your-transaction (KYC) is relatively more secure and can assess and prevent fraud in real time.

Decentralized Exchange (DEX)

A decentralized exchange, as the name suggests, is a crypto exchange that works without a central entity and in a way such that the transactions are totally transparent and peer-to-peer while allowing users to have complete control over their funds and data.

Blockchain Gaming

Another growing use case of Decentralized Finance is in the online gaming space, where developers are looking to boost transparency and reduce the role of middlemen in incentive-focused games.

DAOs

Nowadays, blockchain technology is even being used for creating whole organizations based on the principles of decentralized finance.

DAO stands for decentralized autonomous organization, which is a new kind of corporation made to follow the transparent rules of the Ethereum blockchain and to be managed in a fully decentralized manner.

Derivatives

Digital or token-based derivatives are digital securities whose value is derived from the value of underlying assets and that work on agreements made on smart contracts.

Digital Identity

Biometrics blockchain technology vector illustration of digital fingerprint security for cryptocurrency concept.

Data communication server and secure access scanner on purple ultraviolet background

A lot of people around the world remain deprived of basic necessities and government incentive schemes because of the lack of proper identity credentials.

At the same time, the lack of a proper mechanism to store and share identities in a secure manner limits access to modern services.

DeFi can be used for creating a global, blockchain system for securely storing, managing, and sharing digital identities in a transparent manner.

Voting

Digital voting is not a new concept. The inclusion of decentralization can bring more transparency and reduce the probability of human errors in all kinds of elections.

Decentralized Marketplace

A decentralized marketplace is like a regular marketplace, where one can buy/sell products or services, except that it’s built on blockchain technology and works without a central authority or owner.

Users can trade directly with each other through smart contracts and pay securely using cryptocurrencies.

Staking

Staking is the mechanism that allows users to earn rewards by staking their crypto. With Ethereum’s transaction to ETH 2.0, which uses a Proof of Stake consensus method, users will be able to stake their ETH and make money.

Tokenization

Tokenization refers to the process of converting a physical asset into digital securities called tokens.

Tokens are operated and transacted on a blockchain and can increase the liquidity of physical assets such as real estate, making them easier to transfer.

If you’re interested in tokenizing your property, our real estate tokenization development company is ready to guide you through the process. Don’t miss this opportunity – reach out to us today!

Decentralized Finance (DeFi) Development

Many organizations are already building on DeFi, and you can too. You can choose from any of the above use cases or create your own way to benefit your community through the use of Decentralized Finance.

So, now the question is how you develop your application on DeFi.

Well, you can always try & learn about Decentralized Finance (DeFi) blockchain development. But, it’s easier said than done.

The main problem is that the resources to learn Decentralized Finance (DeFi) blockchain development are quite limited since the blockchain is still a new technology.

Also, the cost and time to learn a new skill can be significant, unless, of course, you are a developer looking for career growth, in which case it will be worth it.

A better, more cost-effective, and definitely the most efficient option would be to hire an expert DeFi developer with experience in building applications on Blockchain.

At SAG IPL, we have been building DeFi/Blockchain applications for almost 10 years now and have experience in building a variety of DApps, including DEX, digital wallets, ICO, smart contracts, and more.

SAG IPL Provides The Following Decentralized Finance (DeFi) Development Services:

DeFi Staking Platform Development

It involves the development of a dedicated staking platform on DeFi, allowing users to earn rewards by depositing crypto in the system.

DeFi Yield Farming Development

Yield Farming development refers to building a DeFi platform to allow users to lend/borrow cryptocurrencies and make more crypto from their funds.

DeFi Lending & Borrowing Platform

The development of a decentralized platform for easy & quick lending of digital assets to those in need, in exchange for interest.

DeFi Smart Contract Development

A digital contract that can be customized with code to accomplish almost any kind of digital financial transaction on the blockchain.

Defi Application Development

Hire expert blockchain developers to build a variety of decentralized applications on highly secure and robust blockchain technology.

Defi Token Development

Convert your real assets like property and gold into digital assets through our DeFi token development services to increase liquidity.

Defi Wallet Development

Get your own custom decentralized wallet developed, enabling users to securely & privately store and transact their digital currencies & assets.

Defi Marketing Services

We also provide a complete suite of DeFi marketing services, including ICO marketing, social media, SEO, paid marketing, content marketing, and more.

DeFi E-commerce Development

Build your fully-featured, one-of-its-kind decentralized online store on blockchain technology to provide services & products free of middlemen.

Defi Crowdfunding Platform

A decentralized crowdfunding platform that lets small businesses & individuals find and trade with investors in a peer-to-peer manner.

Defi ICO Development Services

Build your ICO website and marketing campaign from scratch with our highly efficient ICO development services and raise funds successfully.

DeFi Exchange Development

Build a decentralized exchange platform, allowing users to buy/sell cryptocurrencies easily and at a low cost and without a middleman.

DeFi Protocol Development

Have an idea for a DeFi app? Let us build your DeFi protocol on Ethereum or custom Decentralized Finance (DeFi) Development to take your idea to the next stage.

Looking To Find Out More About Decentralized Development & How It Works.

Set Up A Free, 15-Minutes Meeting With Our Blockchain Expert Now!

Conclusion

Decentralized Finance (DeFi) deals with the development of a new kind of finance ecosystem that is independent of traditional, centralized financial systems and entities.

A number of companies, including top organizations such as IBM, are building DeFi applications and systems on the blockchain, which means the technology has real potential to disrupt the financial industry as we see it.

At the same time, DeFi is also prone to many drawbacks. Smart Contracts, for instance, are computer codes, which means they can be hacked or may have bugs.

Also, since everything is under the control of the users, the risk of user errors is high.

The thing to understand here is that DeFi is still a growing industry, and there is a lot yet to come. As more and more businesses start building on the blockchain, the problems will be solved and new solutions will be created.

Looking to hire a full-service DeFi development company? Call today to schedule a meeting with our project manager.

![Explore Different Types of Cryptocurrency Development [2024] Different Types of Cryptocurrency Development](https://blog.sagipl.com/wp-content/uploads/2024/02/Different-Types-of-Cryptocurrency-Development-250x150.jpg)