Funding is one of the core requirements for the success of innovation, which is why concepts such as IPO (initial public offering) and ICO (initial coin offering) have become quite popular in the last few decades.

These are some popular ways used by companies or entrepreneurs to raise funds for their projects. While IPOs are used for funding traditional projects or companies, ICOs are the best way to fund a blockchain project. In this article, we take a look at some interesting ICO Statistics for 2024.

In 2024, there are 13,217 different cryptocurrencies being used. But a lot of them aren’t active or valuable at all.

Initial Coin Offerings (ICOs) have been the real driving force behind the evolution of decentralized finance and blockchain ecosystems. Without funds, it was nearly impossible to turn ideas like Ethereum or Binance into reality.

ICOs provide a convenient and secure way for founders to get money for their projects in the blockchain space while giving investors a wonderful opportunity to join futuristic projects at an early stage.

Let’s dive deep into the heart of ICO Statistics, understanding the various trends, stories, and challenges that define this industry.

Are You Looking for ICO Marketing Agency? Fill out the form:

What is ICO?

ICO refers to Initial Coin Offering, which is a popular way for new cryptocurrency projects and companies to raise funds from interested investors. It’s like a crowdfunding campaign, similar to an IPO, where the project founders offer their crypto tokens (coins or tokens) in exchange for investment.

Investors looking to invest in a high-potential project to make quick or long-term profits can participate in an ICO to buy tokens using cryptocurrencies like Bitcoin or Ethereum.

Different types of ICO tokens offer different features and benefits. A utility token, for instance, grants access to a specific project or platform being developed by the token creator. In addition, they get to benefit from the increase in the value of the purchased tokens over time as the project develops.

ICOs have become extremely popular as a means for blockchain startups to secure funding for their creative projects that people might be interested in joining at early stages.

What are ICO Statistics? Why are They Important?

ICO statistics encompass crucial data and facts on Initial Coin Offerings (ICOs), revealing helpful insights into the cryptocurrency, token, ICO, and blockchain industry. This information may include, but is not limited to the number of ICOs, most successful ICOs, facts, figures, funds raised, success rates, token value, and token distribution. Investors can utilize these ICO stats to expand their crypto industry knowledge and make informed investing decisions, assessing risks and rewards based on past performance and trends.

| Metric | Value |

| Worldwide Crypto Users in 2024 | Approx 833 million |

| Daily Crypto Trading on Binance 2024 | Bitcoin All-Time High |

| Bitcoin All-Time High Price in 2024 | $73,835.57 |

| Worldwide Crypto ATMs in 2024 | Approx 40,000 |

Regulatory bodies may leverage ICO data for monitoring, formulating and upgrading investment guidelines for ICOs, ensuring investor protection and market integrity. The following statistics will also help you understand the crypto market’s viability, track economic trends, and observe trends to make informed decisions when it comes to investing in a new ICO or cryptocurrency. So, without further ado, let’s read about some interesting ICO industry statistics and trends.

Important ICO Stats for 2024 and Beyond

ICOs were created as a convenient way for early-stage blockchain projects and companies to raise funds, and they have proven to be immensely successful. Some of the most popular ICOs, such as EOS, Ethereum, and NEO raised billions or millions through their token sales, which greatly contributed to their projects’ success later on.

However, the ICO market has also been infamous for a considerable number of fraudulent projects and scams run by people or organizations looking to rob investors with the promise of outstanding returns within a few days.

Let’s take a look at some exciting stats, facts, and news about the ICO industry over the years.

- The first-ever ICO was MasterCoin – The first-ever ICO token sale was launched in 2013 by J.R. Willet. The token was called MasterCoin and raised an amazing $500,000 worth of Bitcoin through the ICO. Its success inspired many ICOs after this.

- US is the Top ICO Country – The US is the top country by both the number of ICO Projects and Funds Raised in a year, with an average of 100+ projects listed every year and over $300 million in funds raised.

- Unlike IPOs (initial public offerings), ICOs are not generally regulated, i.e. not governed or managed by legal entities such as the SEC.

- ICOs are not allowed or considered legal in every country. Some jurisdictions, including Korea and China, have completely banned participation in ICOs.

- Due to the lack of regulations, ICOs may be prone to scams and fraud, as anyone can enter the ICO market to raise funds for a fictional project.

- Fewer than half of all ICOs make it past four months after the token sale.

- Despite a record 50% ICO failing in 2018, more than $7 billion was raised by projects during the year.

- Ethereum, one of the most successful ICOs of all time, raised around 31,000 BTC through its token sale in July 2014, which was around $18.3 million at the time and is over $2 billion now.

- 2018 was the year when the ICO market witnessed an unanticipated growth with more than 1,000 ICOs launched in a year for the first time. However, a large number of them turned out to be unsuccessful.

- Funds raised through ICOs surpassed traditional venture capital funding numbers by over 3-4 times between 2017 and 2020.

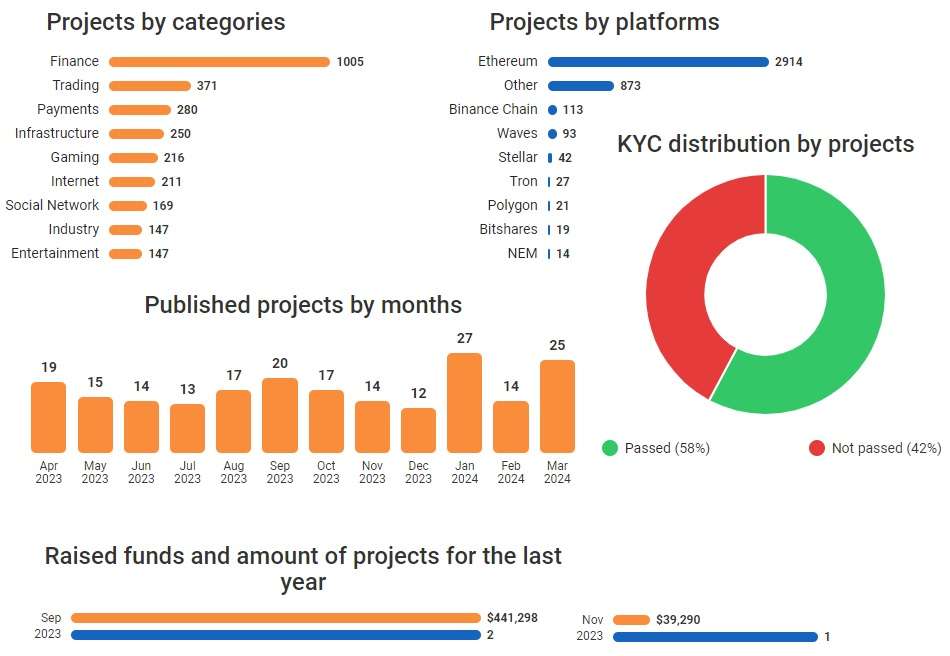

- Finance is the number one category in terms of ICO projects in a year. This is followed by trading and payments.

- The ICO for Brave, a privacy-focused web browser launched in 2017, generated around $35 million in just 30 seconds.

- As of January 2018, Filecoin, with a whopping $257 million fund raised in their token sale, was the highest-grossing ICO at the time.

- Security tokens are a type of ICO token that are regulated just like traditional securities and are considered the most secure type of ICO, also called security token offerings (STOs).

- Ethereum, with a market share of over 80%, is the most favoured ICO development platform. It uses the popular ERC-20 standard for token development.

- ICOs are accessible all over the world and anyone can invest in them.

- An ICO platform is the website where an ICO sale is conducted. It can be either the company’s own website or a third-party platform dedicated to ICO launch, such as IEO (initial exchange offering).

- Hard cap in ICO refers to the maximum supply of a particular cryptocurrency. In simple words, this is the maximum number of tokens available for sale.

- Soft cap in ICO refers to the minimum supply of a particular cryptocurrency. In other words, this is the minimum number of tokens the company is looking to sell in the ICO.

- Tokenomics refers to the numbers around an ICO token, such as the total supply, the number of tokens for sale, the number of sale rounds, etc.

- An ICO white paper is a document providing details of the project, ICO, and the token, including the project concept, mission & vision, features, tokenomics, ICO sale, about the team, project roadmap, etc. for the benefit of investors.

- ICO marketing refers to the process of promoting an ICO sale. It includes digital marketing techniques such as community building, social media marketing, email marketing, content creation, video promotion, and influencers and KOLs, among others.

- Currency tokens, utility tokens, and security tokens are some popular types of ICO tokens. However, over 80% of ICO projects only use utility tokens.

- By December 2022, blockchain projects and startups have raised over $50 billion through ICOs.

- From 2019, ICOs witnessed a sharp decline, mainly due to challenges such as fraudulent activities and participants, project failures, and scams.

- There were only about 109 ICOs in 2019, collectively raising just around $370 million. The figure further dropped to just $117 million raised by 217 ICOs in 2022.

- To offer a more credible and secure alternative to ICOs, multiple alternative crowdfunding options were introduced between 2019 and 2023. These include Security Token Offerings (STO), Initial Exchange Offerings (IEO), Initial DEX Offerings (IDO), and Token Generation Events (TGE).

- BITFINEX (Taiwan) was the most successful ICO in 2019 and raised a total of $1 billion.

- More than 85% of all ICOs released in 2019 were based on the Ethereum blockchain.

- According to a 2020 ICO analysis report, almost 60% of all ICOs in 2019 did not have an actual product for the market.

- 36% of all ICOs in 2023 were from the finance domain, i.e. of projects building financial products, such as DeFi.

- Some of the most successful ICOs in 2023 were World Coin (raised $240 million), Arbitrum (raised $123.7 million), and SUI (raised $52 million).

- According to a Cryptorank report, out of all token sales between 2014 and 2023, more than 18% were ICOs.

- IDOs, with a remarkable share of over 66% stood in second place, followed by IEO at the third place with over 15% market share.

- Nepal, Bangladesh, Macedonia, and Bolivia, are among the countries, besides China, that have banned ICOs.

- ICOs often face scrutiny around the world owing to challenges such as the risk of money laundering and the use of ICOs to finance terrorism.

- The average ICO campaign duration is 40 days.

- In July 2017, the ICO of CoinDash was hacked and over $7 million in ETH was stolen by hackers in just about half an hour.

- The biggest ICO scam to date was Bitconnect, which raised over $2.6 billion from investors with the promise of up to 40% returns, but it turned out to be a scam.

- ACChain, another major ICO scam, resulted in a loss of over $60 million of investors’ money. Pincoin, Plexcoin, and Savedroid are some other major ICO scams.

- According to a 2018 report, out of 1,500 ICOs released during the year, 78% turned out to be scams. However, more than 70% of funding received by ICOs was utilized for building high-quality projects.

- Out of 5,036 ICOs studied by a report between August 2014 and December 2019, 57% were scams and resulted in collective losses of over $10 billion.

- ICOs backed by larger teams have an overall higher success rate than ICOs run by smaller teams.

- ICOs with larger communities or online networks usually have a higher probability of success compared to ICOs with limited community reach.

- The availability and quality of the whitepaper are other crucial factors to influence the success rate of ICOs. Projects with detailed whitepapers have a higher success probability.

- ICOs tend to have higher average overall returns than traditional investments such as equities and commodities. However, the risk of loss is also much higher.

- As compared to around 23% losses in IPOs over six months, ICO investments resulted in close to 90% losses during the same period.

- According to a 2020 study, the average ICO receives around 4,700 contributors and raises around $12.5 million.

- On average, an ICO investor contributes around $1,200 to a project.

- Around 1% of all ICOs have received funding of over $100 million each.

- Close to 2% of all ICOs have received funding of more than $50 million but less than $100 million.

- According to a 2018 study, investors, on average, earned returns of 179% between the ICO end date and the listing date.

- Because tokens are sold at a discounted price during ICOs, the returns from the token’s listing price tend to be well over 100% with an average holding period of just 16 days.

- The ICO token growth after listing largely depends on the underlying value and capacity of the project. Many ICOs fail in the long term even after generating splendid listing gains due to poor project development or execution.

- More than 90% of all ICOs use token marketing, which is an extremely effective way to boost an ICO’s success probability.

- According to a 2020 study, around 90% of all ICO tokens were trading below their ICO price after six months.

Conclusion

The ICO industry has changed significantly since the launch of the first ICO back in 2013. ICO statistics presented in this article outline the continued growth and maturation of the ICO market over the years, showcasing both the opportunities and challenges (risks) that participants or investors have to face.

With the increasing interest of global investors in the blockchain industry, it is apparent that more stringent regulations will be introduced to reduce scams and protect investors’ interests in ICO. As an investor, you’re advised to always do your due diligence before investing in cryptocurrencies or ICOs and invest based on your risk profile.