Table of Contents

In today’s modern world, people are quite passionate about smartphones and like to do most of their activities or work on their Smartphones. Goods and Service Tax (GST) has been a complex taxation structure in India since Independence and it rolled out on 1st July 2017.

At SAG IPL, we developed the GST Helpline App in order to provide the best platform for GST-related queries from the general public of India. SAG IPL is one of the renowned GST Mobile App Development Companies in India.

Till now, we have created more than 100 App solutions for national and international clients.

Filing GST returns online is one of the effective and considerable ideas, which have made people’s life easier and better. It saves time and protects from the complex taxation structure. People don’t need to go to the government office to file taxes and wait in a long queue.

GST Software

GST helpline App Android

GST helpline app for iOS

E-filing or filing returns online is very popular these days and people are asking how to avail of this facility. Apart from this, people are also asking IT companies to develop an effective GST Application for the ease of taxpayers and users.

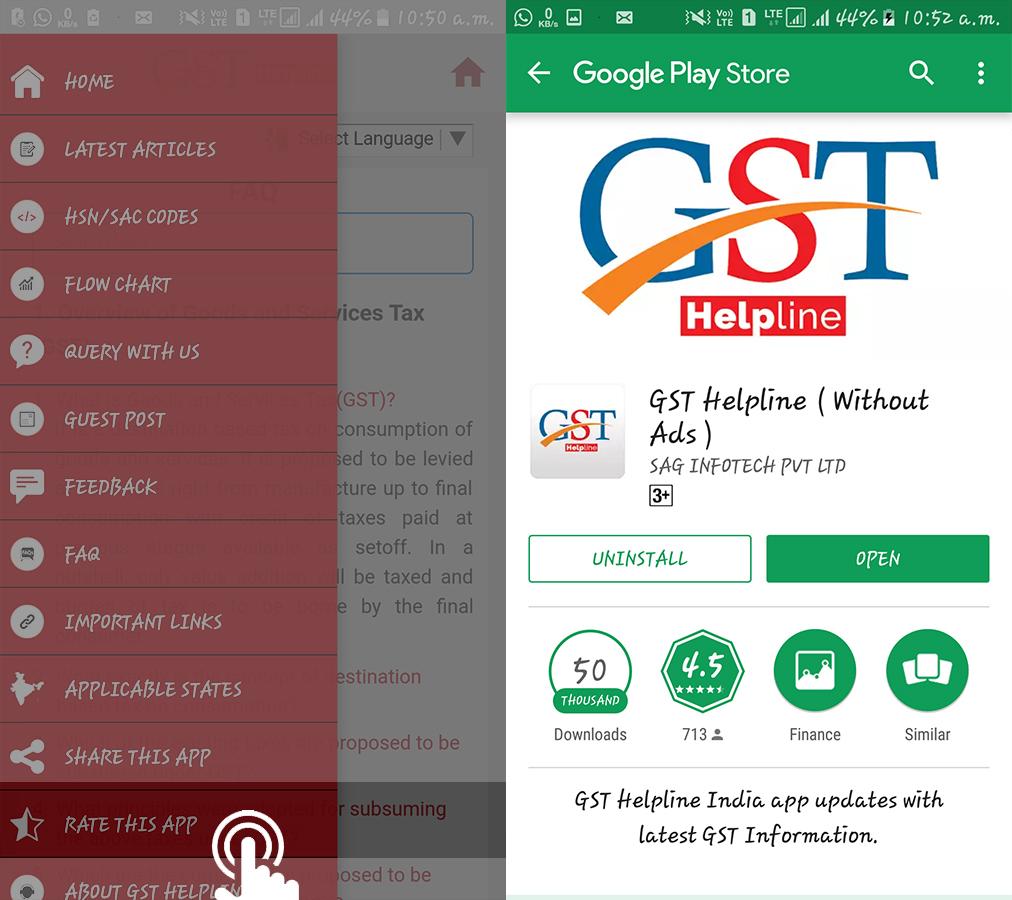

We developed the GST Helpline App for the Jaipur-based firm named SAG Infotech PVT. LTD. Due to the high demand for GST applications, We decided to discuss the common features of the GST App.

Some of the clients want to create a new GST App, whereas some want an update in technology and features in their existing application. GST Application allows Android and iOS users to file returns from any place online with the help of a smartphone.

GST (Good and Service Tax) Mobile App Features

Some of the advanced features of the GST Helpline App are mentioned below:-

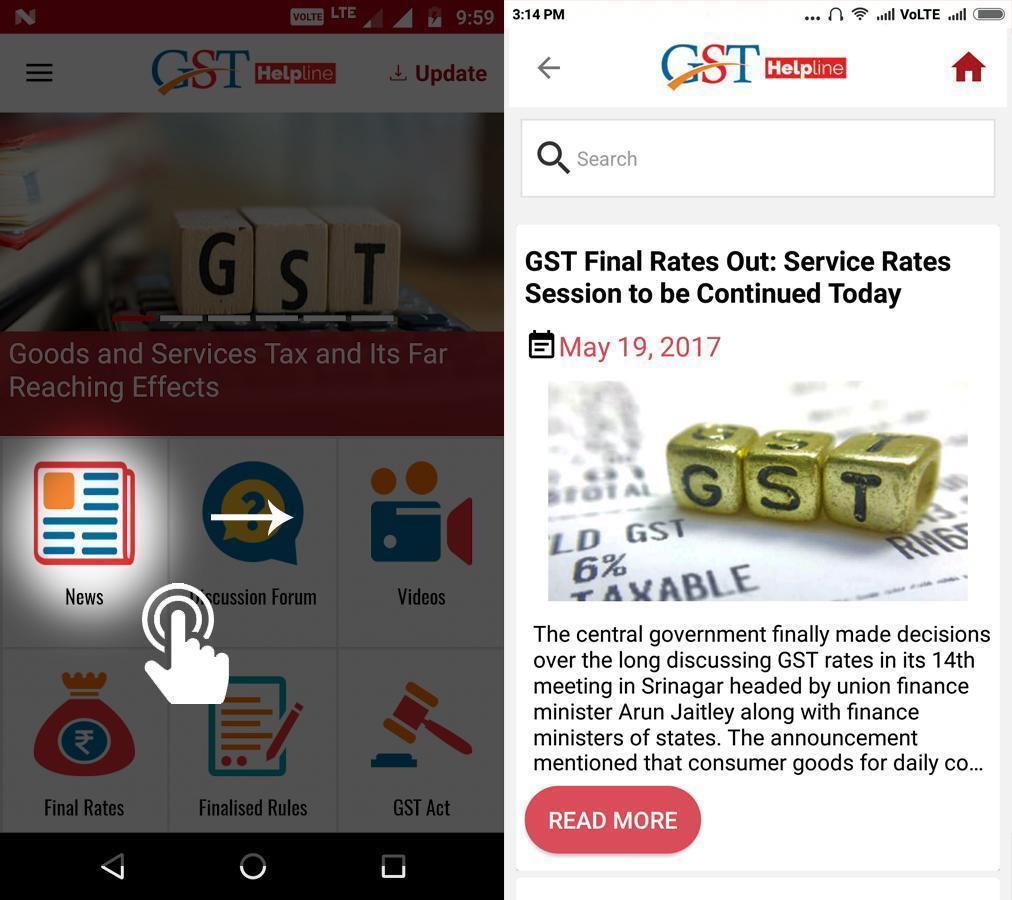

- News: – What is happening across the globe or the latest news related to the GST implementation will be covered under the news section. It will be updated on a daily routine basis.

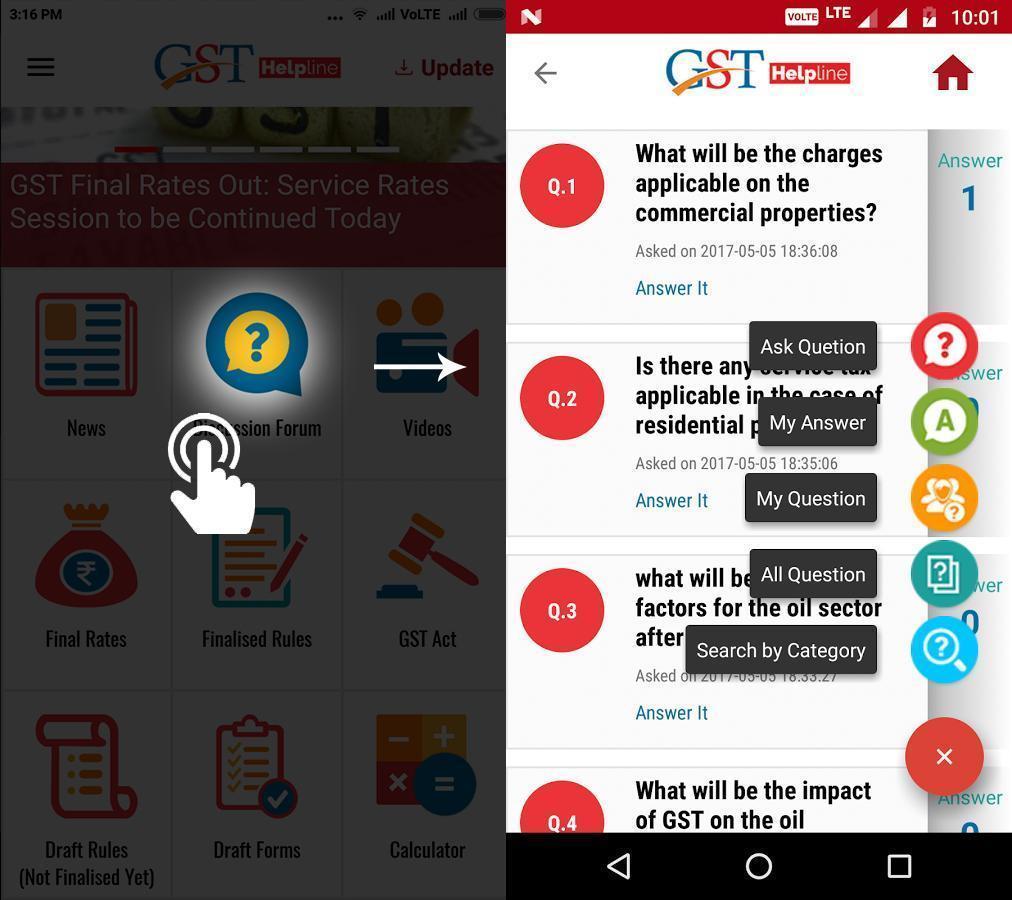

- Discussion Forum: The discussion forum is one of the highlighting features of the GST Helpline App. Here you can discuss queries related to the GST regime in India. Your queries will be solved by a qualified professional and you will get an automatic notification.

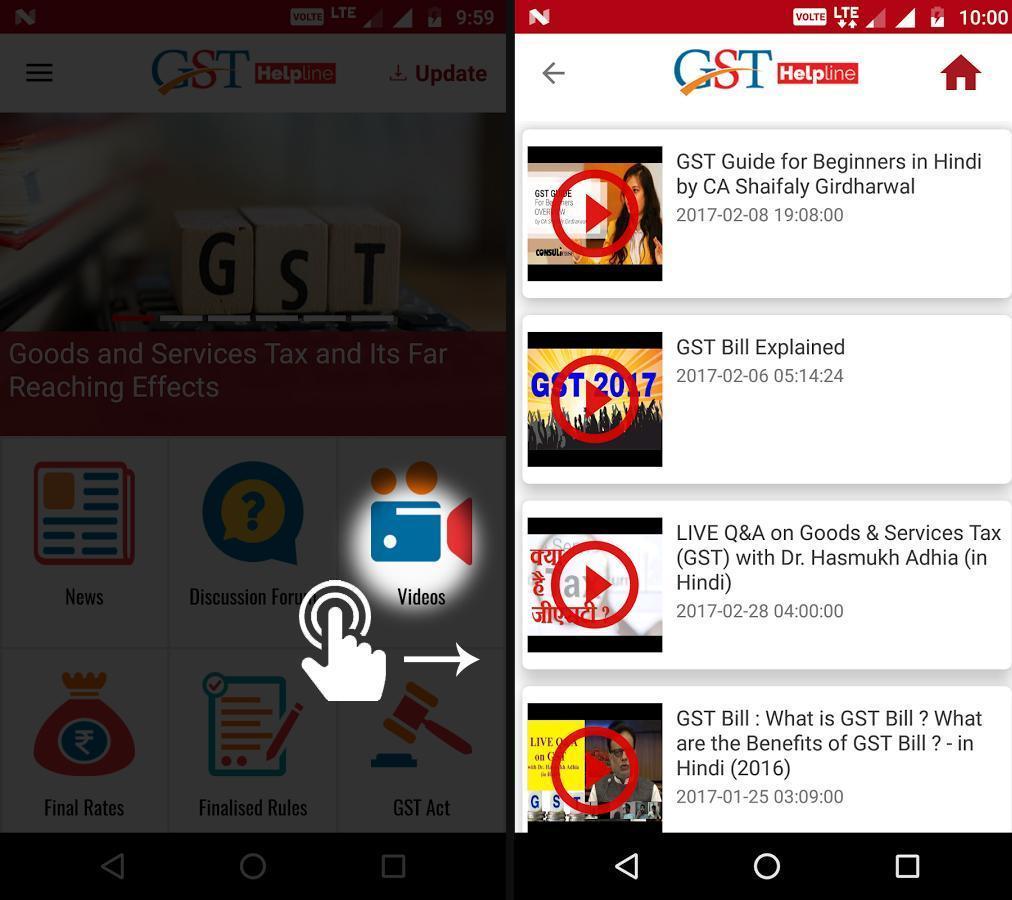

- Videos: – Videos created by our team related to the GST compliance in India, new videos will be uploaded on daily routine schedule. Through videos, it allows people to understand the concept and impact of GST implementation in India. Apart from this, it also includes the registration process of GST and process of filing taxes.

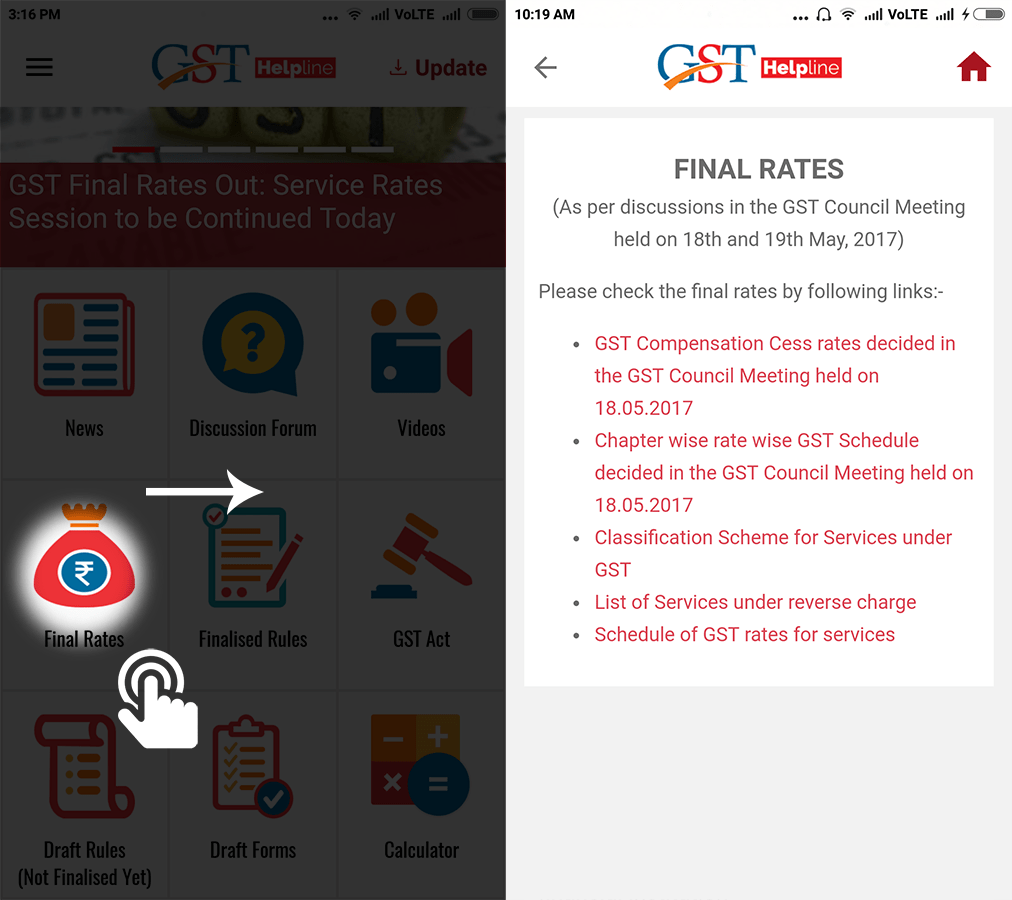

- Final Rates:– GST Council Meeting has categorized goods and services in different slab rates, i.e., 5%, 12%, 18%, 28%. GST council has also decided that high taxes will be levied on sin goods, luxury goods, and aerated drinks.

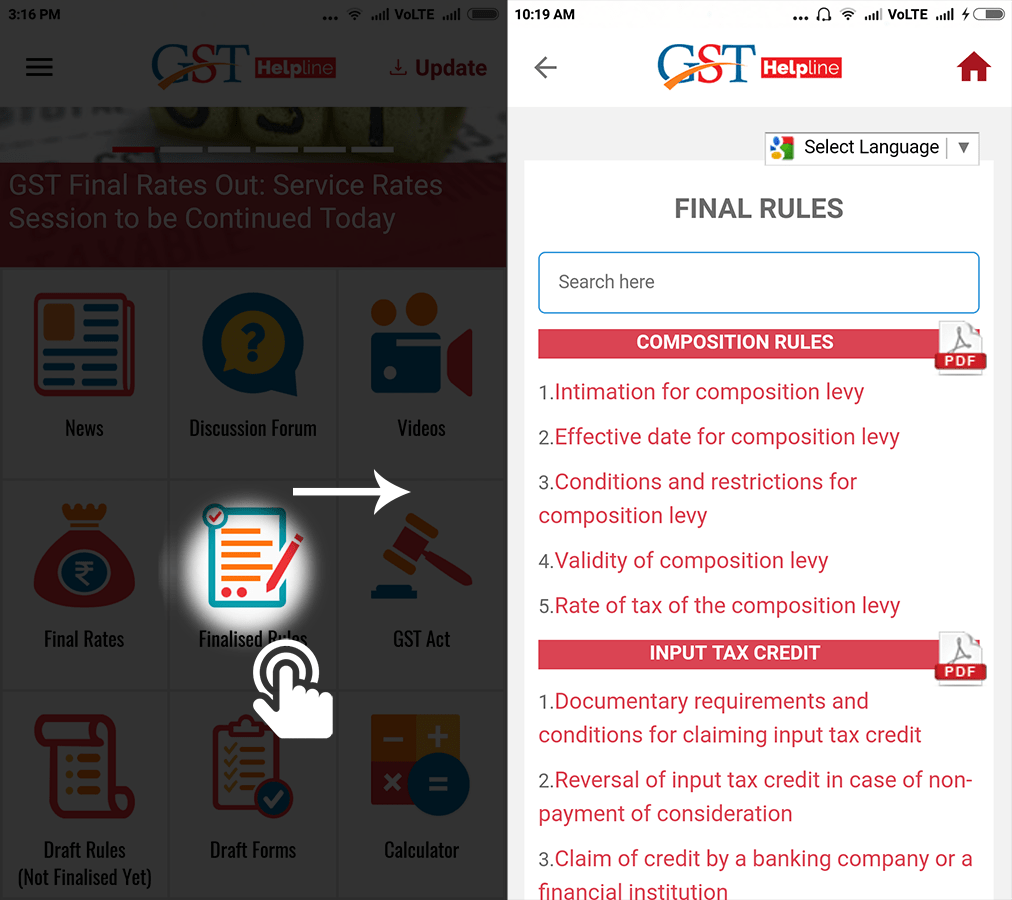

- Finalized Rules: – Finalised GST Rules that have been passed and declared by the Parliament in GST Council Meeting. All rules are available here in PDF format. These rules will be applied after the implementation of GST in India. Here you will get files in PDF format on a variety of topics like composition rules, input tax credits, tax invoice,s and so on.

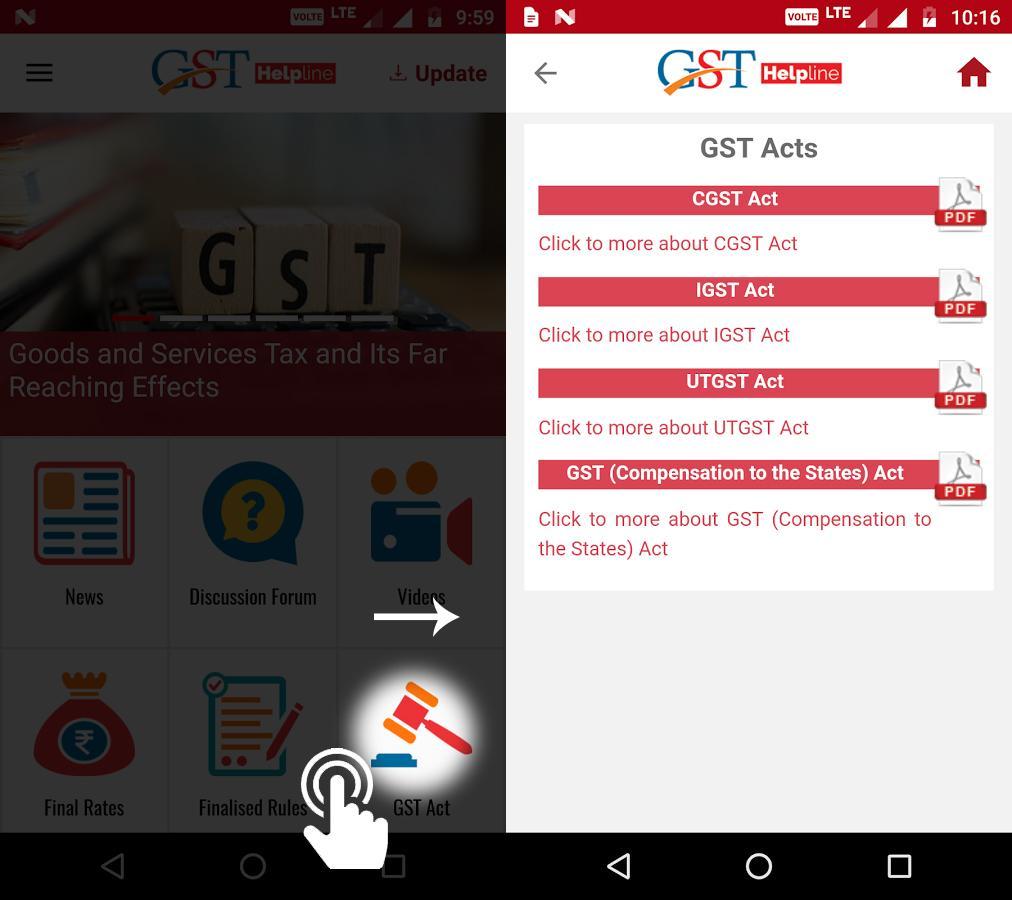

- GST Act: – GST law or act that has been approved by the Government will be covered under the GST Act. Different types of GST act like GST Draft Law, Model IGST Law, and Draft GST Composition law pdf files are mentioned here. You can view all of the files in offline mode.

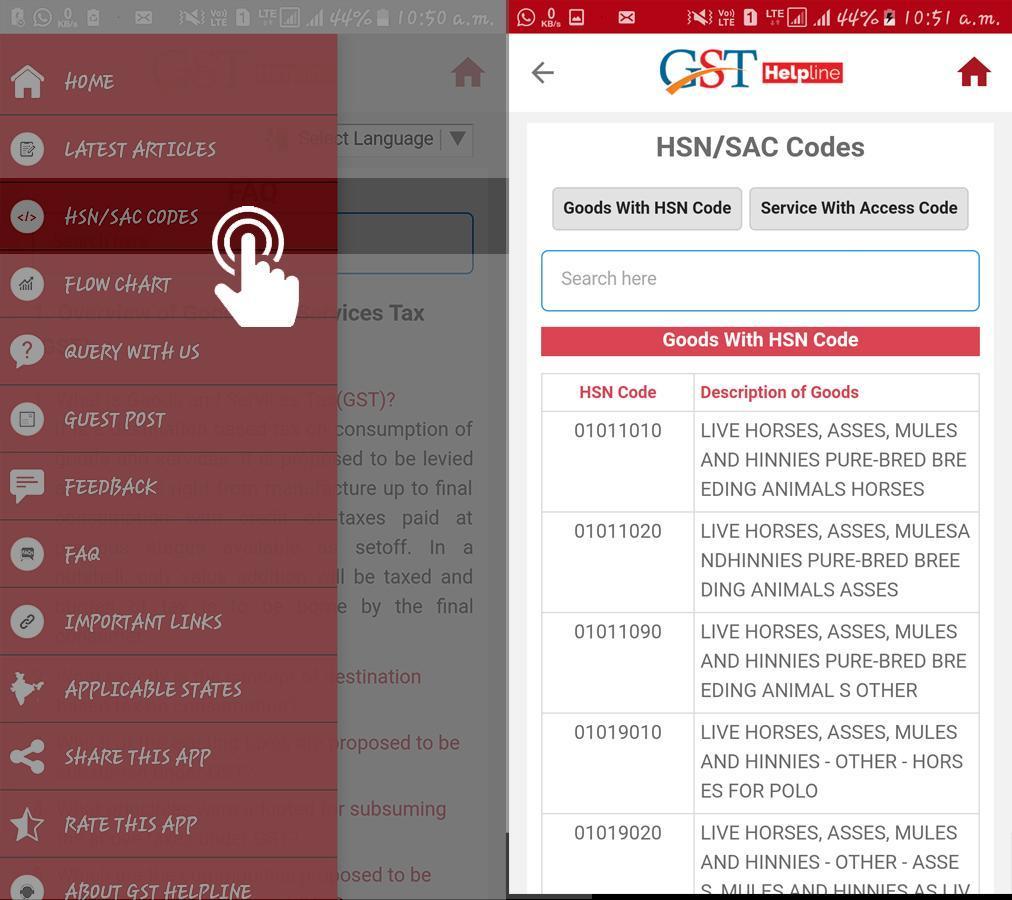

- HSN/ SAC Code: – HSN and SAC codes will be required for filing tax returns according to the annual turnover. A list of HSN/ SAC codes will be mentioned in this section for the feasibility of taxpayers or users.

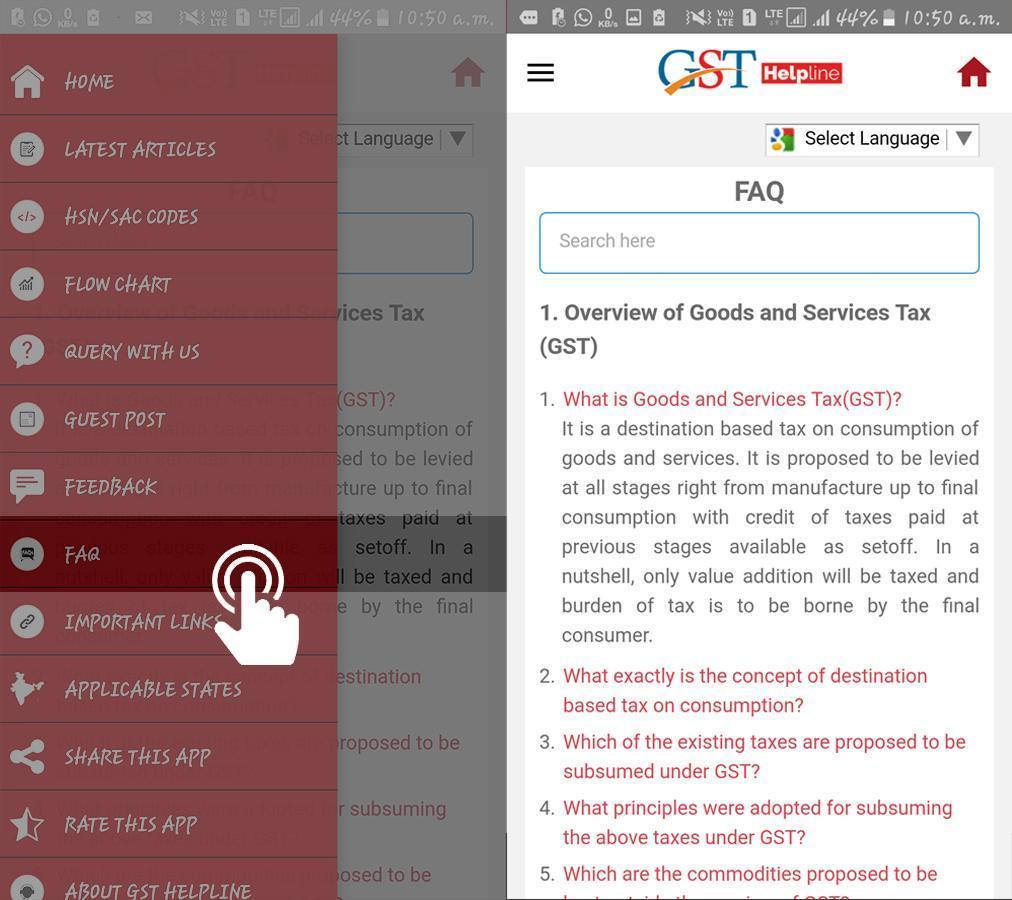

- FAQ: – FAQ section covers common or general questions related to the GST implementation in India. Questions like what will be the impact of GST in the Oil Industry, What will be the charges applicable to commercial properties and so on.

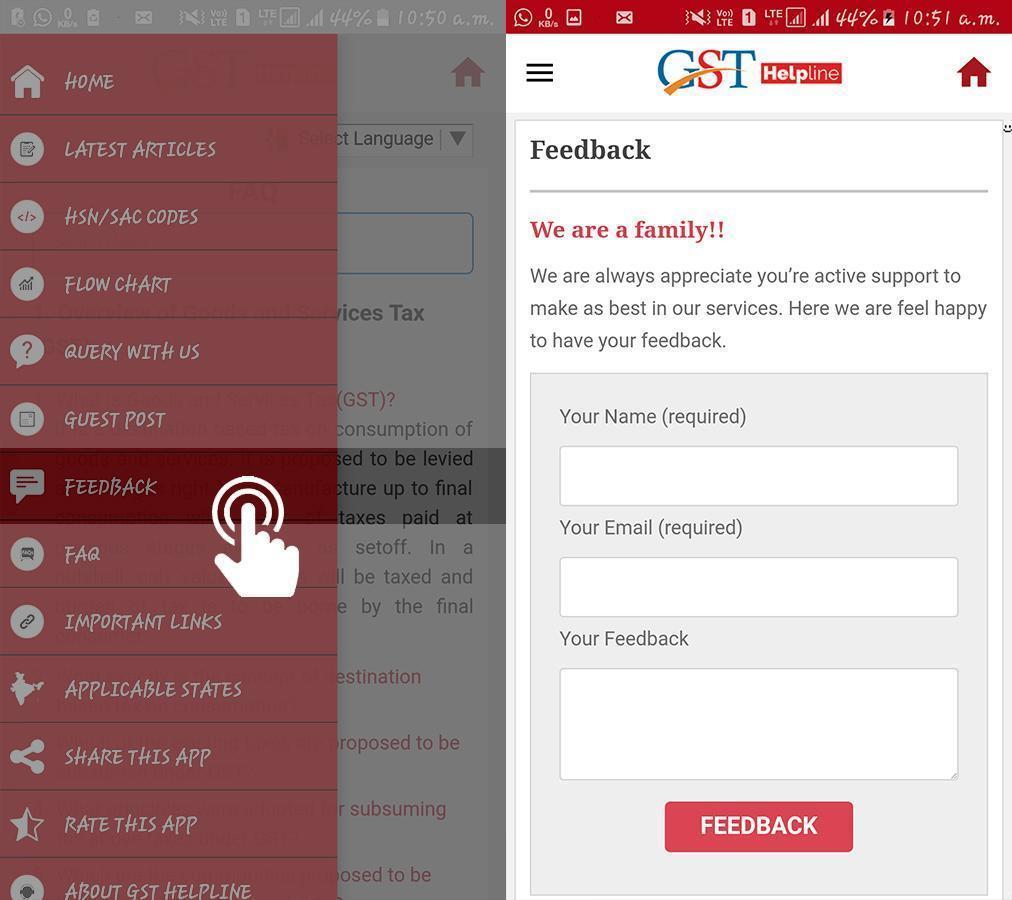

- Feedback: – Users share their personal experiences while using the app. We always concern users feedback.

- Rate this App: – The ‘Rate this App’ section of the application allows users to rate the app from 1-5 points along with the valuable feedback that can be used to improve the application.

Conclusion:-

If you are looking for a taxation application, enquire with us. SAG IPL team will call you and understand your requirements. As per your requirement, we try to deliver your project within a timeframe and under the effective cost budget.

![Live Video Streaming App Development Solutions [2024] Live Video Streaming App Development](https://blog.sagipl.com/wp-content/uploads/2023/09/Live-Video-Streaming-App-Development-250x150.jpg)